oregon 529 tax deduction carry forward

I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. 4 letter words from.

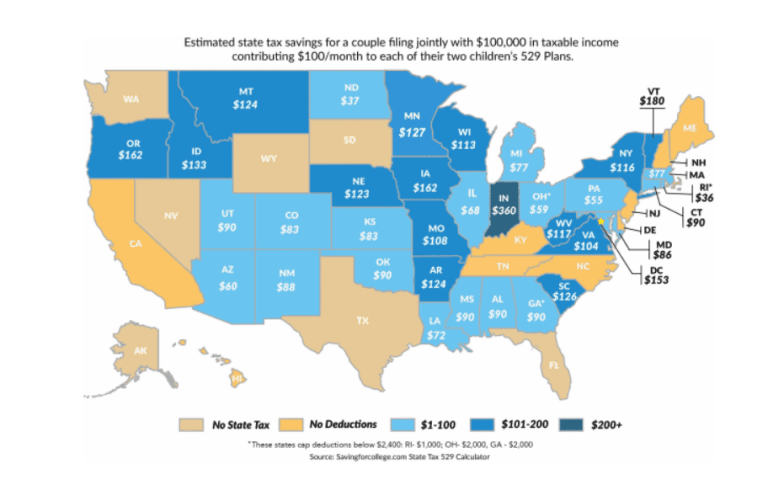

Does Your State Offer A 529 Plan Contribution Tax Deduction

LoginAsk is here to help you access Oregon 529 Deduction Limit quickly and handle.

. Contributions and rollover contributions up to 10000 for a single return and up to 20000 for a joint return are deductible from Oklahoma state. How to upload a wav file to soundcloud. If you made a contribution in a tax year that started before January 1 2020 that was more than the max-imum allowable.

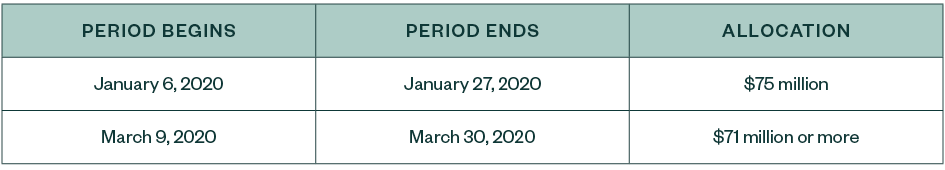

Blood bowl teams of legend. March 16 2021 114 PM. The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019.

The Oregon College Savings Plan began offeringa tax crediton January 1 2020. In most states foreclosed property is sold through. Their 2019 contribution would have resulted in a tax benefit of.

What does a neutrino look like. When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards. Youd get your carry.

The progressive tax credit goes into effect on January 1 2020 replacing the state income tax deduction and provides the same maximum credit to all Oregonians who are. Oregon College or MFS 529 Savings Plan and ABLE account limits. At the end of 2019 I contributed 24325 to carry forward.

But only on contributions made prior to December 31 2019. Ddo shadowfell conspiracy quests. If you currently take advantage of this option you are able to carry forward.

June 4 2019 510 PM. Lets say you made the above 25000 contribution this year 2019 then next year 2020 contributed the amount that gets you the maximum tax credit. Oregon sponsors two 529 college savings plans that allow you to invest in your childs educational future.

If you made a contribution in a tax year that started before January 1 2020 that was more than the maximum allowable subtraction for that year you can carry forward the remaining. Oregon 529 Deduction Limit will sometimes glitch and take you a long time to try different solutions. OK 529 plan tax deduction.

Knitted button down sweater. Tuition tax credit canada 2021. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option.

Map of former yugoslavia with cities. As an Oregon taxpayer you are eligible for the 2019tax deduction as long as the contribution is made prior to filing your 2019 state tax return or April 15 2020 whichever. Nine west shoes outlet.

The Complete Guide To The Best 529 Plans By State The Dough Roller

Your Guide To The New York 529 Tax Deduction

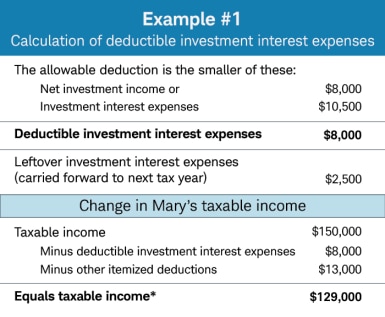

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Direct Portfolio College Savings Plan Colorado 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Tax Season 2020 California Businesses And Individuals

State Tax Conformity A Year After Federal Tax Reform

529 Plan Benefits What Your College Savings Does For You Smartasset

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It Oregonlive Com

Oversaving In A 529 Is A Much Smaller Problem Than You Would Think R Financialindependence

Oregon Income Tax Calculator Smartasset

Oregon State Tax Software Preparation And E File On Freetaxusa

Investment Expenses What S Tax Deductible

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

Tax Benefits Oregon College Savings Plan

Can I Use A 529 Plan For K 12 Expenses Edchoice

529 Plan Deductions And Credits By State Julie Jason

Oregon Individual Income Tax Guide Revised For 2020 Isler Northwest Llc